Cash Over and Short reconciles what is in the cash drawer vs. what the cash register record says should be in the cash drawer. A firm should note instances of cash variances in a single, easily accessible account. This cash-over-short account should be classified as an income-statement account, not an expense account because the recorded errors can increase or decrease a company’s profits on its income statement. Calculate the sum of the petty cash account’s vouchers you created during the accounting period to determine how much cash you distributed during the accounting period.

Error

Cash shortages are recorded in a separate income statement expense account usually known as the cash short or over account. The cash over and short account is the type of miscellaneous account in the income statement. If its balance is on the debit side, it is usually presented in the miscellaneous expenses. On the other hand, if its balance is on the credit side, it cash short and over will be presented as miscellaneous revenue instead.

Related AccountingTools Courses

- Additionally, misinterpretation of currency denominations, especially in countries with similar-looking banknotes or coins, can result in cash drawer imbalances.

- The cash overage/shortage account is an expense account in the income statement of the business.

- Cash overages are normally recorded in a separate income statement expense account often referred to as the cash over/short account.

- Cash Over and Short acts as a Revenue account when there is an overage.

- Frank, who is the responsible person, has been filling out the voucher during the month, and all the receipts are stapled to the voucher.

- By assigning the responsibility for the fund to one individual, the company has internal control over the cash in the fund.

If the cash in the register is less than the sales there is said to be a cash shortage. Likewise, if the cash is greater than the sales the cash is said to be over. Tracking Cash Over and Short is an important piece of protecting a company’s most valuable asset, Cash, from theft and misuse. It may seem like a small item to track, but think of it from the point of view of a retail or restaurant chain where millions of dollars pass through the cash registers every day. Every time a register is short, the company’s expenses increase and profits decrease. A series of cash overs and shorts may be a sign of theft or other problems in the company.

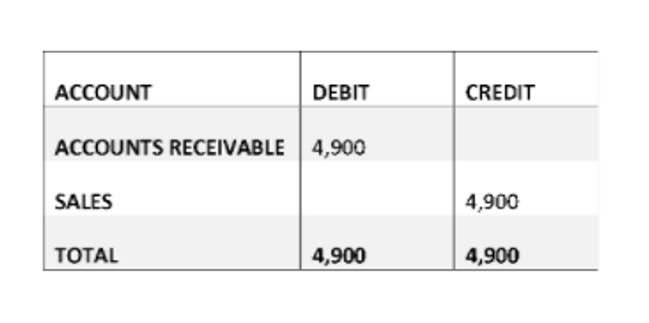

Cash shortage journal entry

For example, at the end of the month, the receptionist of the company ABC needs to request https://www.facebook.com/BooksTimeInc/ reimbursement to refill the petty cash fund of $100. This account is used to record both increases and decreases to profits resulting from errors. Accruing tax liabilities in accounting involves recognizing and recording taxes that a company owes but has not yet paid. This is important for accurate financial reporting and compliance with…

Company

- At all times, the employee responsible for petty cash is accountable for having cash and petty cash vouchers equal to the total amount of the fund.

- It’s important to approach this inquiry with an open mind, considering all possible sources of error, from unintentional mistakes to deliberate acts of theft.

- For example, if the cash in the register is less than the amount on your sales receipts, then you have a cash shortage, reports Double Entry Bookkeeping.

- Alternatively, if there had been too much cash in the petty cash box (a rare condition indeed!), the entry would be reversed, with a debit to cash and a credit to the cash over and short account.

- A sample presentation of the Other Expenses line item in an income statement appears in the following exhibit.

Therefore, the cash over and https://www.bookstime.com/ short is usually at debit balance which represents an expense. This expense is treated as a miscellaneous expense and presented in the income statement as a general and administrative expense section. However, if the balance is at credit, it is treated as miscellaneous revenue instead. As mentioned above, the sales staff or cashier can give too much or too little change to the customer. This difference is treated as income or expense and presented in the income statement.

How to Figure Shorts & Over Entries in Accounting

- Subtract the amount by which you need to replenish the account from the total amount of your vouchers.

- For example, the cash shortage needs the adjustment on the debit side while the cash overage needs the adjustment on the credit side.

- Calculate the sum of the petty cash account’s vouchers you created during the accounting period to determine how much cash you distributed during the accounting period.

- If its balance is on the debit side, it is usually presented in the miscellaneous expenses.

- Only when the fund is reimbursed, or when the end of the accounting period arrives, does the firm make an entry in the journal.

- But understanding how to record this type of journal entry is essential for properly tracking and balancing your finances.

Let’s assume Tom rang up a $100 pair of running shoes for $100, but he miscounted the cash received for the shoes. The accounting system will show $100 in sales but $101 of collections. The journal entry to record this sale would debit cash for $101, credit sales for $100, and credit cash over short for one-dollar. One of the conveniences of the petty cash fund is that payments from the fund require no journal entries at the time of payment. Thus, using a petty cash fund avoids the need for making many entries for small amounts. Only when the fund is reimbursed, or when the end of the accounting period arrives, does the firm make an entry in the journal.

Discrepancies in cash handling, known as cash over and short situations, can signal underlying issues that need immediate attention. The shortage journal entry is one of many bookkeeping entries used in accounting, discover another at the links below. This term pertains primarily to cash-intensive businesses in the retail and banking sectors, as well as those that need to handle petty cash. If a cashier or bank teller errs by giving too much or too little change, for example, then the business will have a “cash short” or “cash over” position at the end of the day. To record the cash register overage the business needs to enter the cash over of 14 as part of the journal entry used to record the sales as follows. Suppose a retail business starts each day with a cash balance of 200 in the cash register.