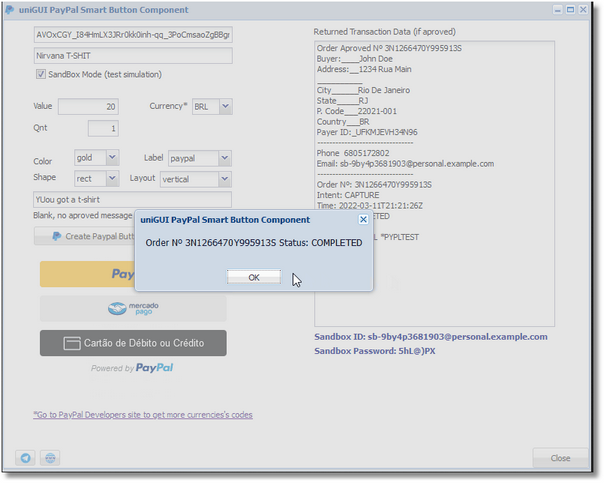

Below so it compliance solution, the collector will bring RBP sees with credit ratings to applicants

Point 1100F of Dodd-Frank Act amended brand new FCRA to provide a lot more revelation conditions whenever unfavorable step try drawn by the customer’s credit rating. Especially, the latest FCRA needs someone to make the pursuing the disclosures in the writing otherwise digitally within the unfavorable action see from inside the inclusion to the people understood within the Dining table 4:

Multiple credit scores

- The latest buyer’s numerical credit score utilized by the individual inside getting adverse step 21

- The variety of it is possible to credit scores;

- Most of the important aspects that adversely influenced the financing get 22 ;

- The latest go out on what the credit get was created; and you may

- Title of the person or organization providing the credit history or perhaps the recommendations upon which get was developed.

However credit rating failed to donate to the choice to grab adverse payday loans Rock Creek Park action, these types of disclosures are not required. 23 You to definitely matter that often comes up is whether or not credit score disclosures are essential to own unfavorable action with the a credit application where in fact the collector currently considering a credit history revelation as creditor uses the financing score different form of complying towards the FCRA chance-dependent prices (RBP) regulations. 24