Selecting the right mortgage normally notably impact your financial coming and you may homeownership sense. To support which vital decision, we’ve collected a relative studies out of Va Fund compared to almost every other popular mortgage systems.

This review is designed to emphasize trick variations and you will similarities, getting a definite, concise snapshot in order to browse the options.

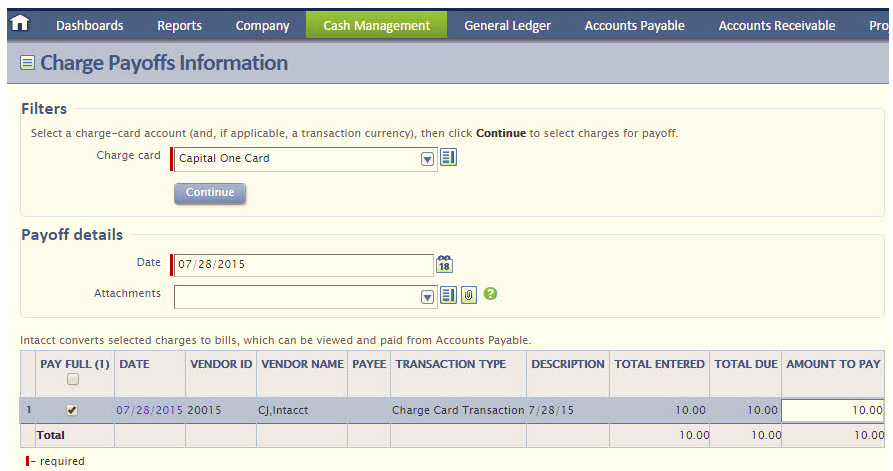

Lower than try a desk that contours probably the most factors each and every. So it artwork book is made to describe cutting-edge suggestions, which makes it easier on how to weighing the pros and downsides of every home loan particular at a glance.

Please note that the pointers provided in this table was an excellent standard book. Rates can be fluctuate according to sector requirements and you can personal lender policies, and you will qualifications requirements possess additional conditions perhaps not fully caught right here. Understand our very own help guide to navigating newest home loan prices for more information.

So it evaluation will act as a starting point on your browse, and in addition we remind one to take a look at the for each and every solution more deeply, especially if one seems to line up along with your finances and homeownership needs.

Whether or not you really worth new no down-payment feature out-of Va and you will USDA Money, the flexibleness out of Antique Loans, or perhaps the entry to away from FHA Loans, there can be a home loan solution customized on the novel means and you will points.

In-Depth Assessment

Now you must to go a tiny higher and you may talk about such home loan solutions. Why don’t we strip right back the fresh new levels each and every mortgage type, exploring the unique enjoys, positives, and you will potential disadvantages.

Our objective is to make it possible for your with an intensive understanding of just how these financing differ used, just written down, so you’re able to make the most informed decision tailored toward book homebuying needs and you will financial points.

Va Financing vs Conventional Fund

Whenever choosing the proper financial, knowing the trick differences when considering Va Loans and you will Conventional Financing was critical for experts and you may effective army players. Each other mortgage systems render unique masters and considerations customized to fulfill diverse financial items and you may homeownership specifications.

Deposit

One of the many differences between Va Money and Old-fashioned Finance is dependent on the deposit requirements. Va Finance was recognized for their 0% advance payment work with, giving unmatched use of homeownership of these with supported. In contrast, Conventional Funds normally want a deposit between 3% so you can 20%, according to lender’s conditions as well as the borrower’s creditworthiness.

Financial Insurance coverage

Another key element is the requirement for home loan insurance policies. Va Fund don’t need private home loan insurance rates (PMI), regardless of the down-payment number, that will result in generous month-to-month coupons for your requirements. Old-fashioned Mortgage consumers, as well, need to pay PMI if the advance payment is actually lower than 20% of the house’s purchase price, adding an additional cost till https://paydayloansconnecticut.com/sacred-heart-university/ the financing-to-worth proportion reaches 80%.

Rates of interest

Rates getting Virtual assistant Financing usually are below those to own Conventional Loans, thanks to the authorities support. This will lead to down monthly installments and extreme savings more the life span of loan. Antique Loan cost have decided of the borrower’s credit history, down-payment, loan label, or any other issues.

Credit Criteria

Va Funds are usually a great deal more versatile which have borrowing criteria, allowing experts and you can energetic armed forces players which have all the way down credit ratings to help you however be eligible for home financing. Old-fashioned Money, but not, tend to have more strict credit score conditions, tend to necessitating a score out-of 620 or more to have acceptance.

Loan Limits

When you’re Va Fund once had restrictions predicated on condition assistance, alterations in modern times has eliminated mortgage restrictions getting individuals with full entitlement, making it possible for the credit regarding house at the large rate things rather than a downpayment. Antique Fund, yet not, comply with loan limits lay by Federal Property Funds Company (FHFA), that vary because of the state consequently they are adjusted per year.