As a homeowner, you understand you to everything is gonna split and possibly your have a crisis loans for that. But possibly funds to possess house solutions are essential in the event your repairs is actually larger than your financial budget.

Before you drop into your discounts, have a look at your residence insurance policy. You loans in Arley are able to pull out an insurance claim. If your coverage discusses new fix you prefer, be sure to understand what your own allowable is actually.

Utilizing your coupons, when you have adequate to shelter brand new resolve, will be a less expensive option eventually. From the perhaps not credit money, you’ll not need to repay it having interest.

You can also borrow funds. Several types of financing or credit lines can be used for unanticipated household resolve assistance. A personal bank loan otherwise range, otherwise domestic collateral financing or line of credit is generally best to you personally.

Reconstructing after an organic emergency

Throughout the aftermath out-of an organic crisis, let is available. Information such as for example insurance, the us government plus financial could possibly assist.

A guide to preserving to have unanticipated costs

For those who have to make use of your crisis family savings, understand how to construct it backup therefore you might be ready getting another surprise.

Common unexpected expenditures and the ways to pay money for all of them

It is possible to plan for this new unanticipated. Here’s a guide to common treat expenditures and just how you can be prepared for them.

Score solutions to prominent questions relating to money for domestic fix.

- Your property insurance policy could possibly get shelter the fix you desire. However, be sure to know what the deductible is.

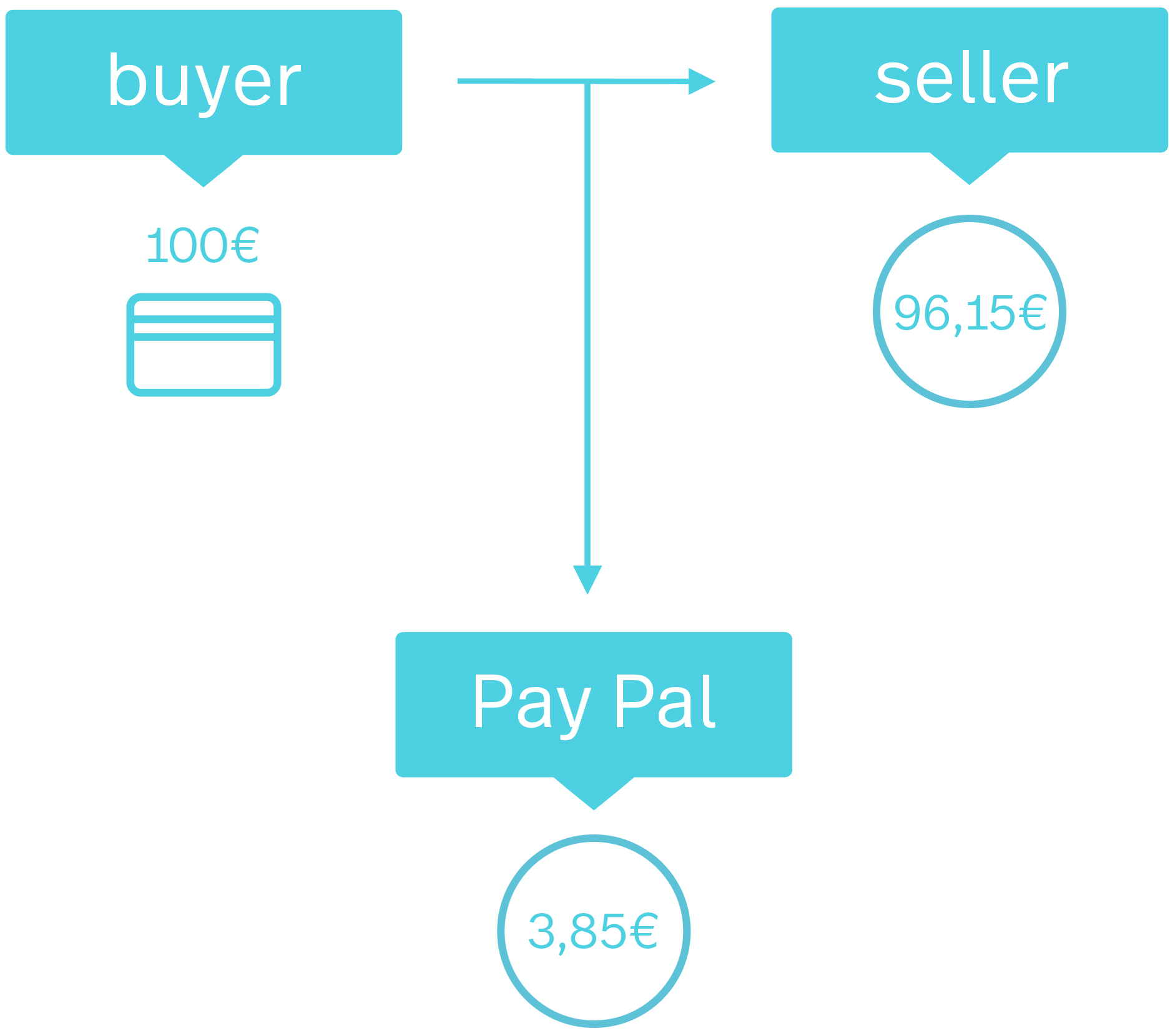

- Having fun with a charge card may be a choice. Remember that bank card rates of interest can be large than just interest rates to have funds. It’s best to pay-off bank card stability right away.

- Different types of financial support can be used for domestic resolve guidance. A consumer loan or range, otherwise property equity loan otherwise credit line can be effectively for you.

You could pertain on the web, from the cellular phone or perhaps in individual getting a personal loan or line out of borrowing, otherwise a house guarantee mortgage or line of credit. The amount of time it needs so you’re able to process your application may vary.

Disclosures

Loan approval are susceptible to borrowing from the bank approval and program assistance. Not absolutely all loan apps appear in every states for all financing wide variety. Interest and you can system terminology is actually susceptible to change without warning. Home loan, Domestic Security and you will Borrowing products are given through U.S. Financial National Organization. Deposit items are provided as a consequence of You.S. Financial Federal Connection. Representative FDIC.

- Usually needed a FICO credit rating out of 680 or significantly more than. We think about the debt-to-income ratio and you will credit history. Whenever you are searching for implementing together, get in touch with a beneficial banker.

- To help you qualify for a line of credit, you must have a current You.S. Bank checking account without reputation of present overdrafts.

- Credit lines is limited by you to for each customer.

- A personal line of credit will bring a financing origin for lingering financial requires. If this sounds like what you would like, or if you seek a beneficial rotating membership having a good changeable price and lowest monthly obligations, an individual range may be right for you.

Want to look at the price before you apply?

To check their rates, we will inquire about particular facts about one to do a silky credit assessment (which won’t affect your credit rating). Possible comprehend the costs you happen to be qualified to possess ahead of doing a full app.

Which link takes you so you’re able to an external site or application, having some other privacy and you will coverage policies than U.S. Lender. We don’t individual otherwise control the items, features or articles located truth be told there.

Your Ca privacy alternatives

We have fun with record technology, such as for example snacks, one gather information regarding our very own webpages. One data is employed for various purposes, particularly understand exactly how folk interact with our very own websites, or even to serve advertisements into the other sites or into the other’s websites. We also use email addresses to deliver behavioural ads for you on third party systems, particularly social networking sites, google search results, and you can other people’s websites.

Also opting-out right here, i along with honor decide-out liking signals such as the Global Privacy Manage. Remember that because of technological limits, for folks who go to our webpages of a different sort of desktop or unit, obvious snacks on your browser, otherwise fool around with multiple email addresses, try to opt-away once more.