Of many borrowers worry about coming up with the downpayment and you will you should initiate rescuing very early to them. Along with, begin very early, what otherwise any time you learn about mortgage down repayments?

Specific individuals who do work on their borrowing from the bank well before applying for a loan may be eligible for a knowledgeable down-payment words. You will be required to build a bigger down payment in the event that your credit rating is actually lowest; financial conditions plus the home loan system you implement around tend to have a state with what you to definitely high advance payment can be.

Conventional down repayments vary, however, if you do not have to pay 20% to eliminate private financial insurance coverage, you’ll exchange a lower down-payment on the private financial cost, which is often payable if you do not started to 20% guarantee home unless of course other agreements was decided.

A good Virtual assistant borrower usually makes No down payment unless of course he could be seeking slow down the amount of new Virtual assistant financing financing payment, and this reduces depending on how far down payment you will be making. USDA funds have a similar no-money-down feature, but USDA fund are you desire-established, and possess children (Not personal) money cap that can implement regardless of how most people are compelled toward loan.

Virtual assistant funds are to possess qualifying army participants, USDA financing is actually need-built. FHA mortgage loans, in comparison, are a lot a lot more accessible to normal household candidates employing reduced step three.5% advance payment criteria within the normal times.

Consider the solution to get a district down-payment guidelines or homebuyer’s offer having an enthusiastic FHA home loan. You can even negotiate on provider to provide a specific number of help from the vendor to have settlement costs.

Their down payment expenditures might not already been 100% with your own money with help along these lines, however the FHA doesn’t have anything related to particularly deals and you may it would be your choice to acquire a deposit guidance bundle in your geographic area.

FHA loans might provide just the right debtor with the assist a beneficial debtor has to come across or build a separate house, probably the first-time aside. Communicate with a performing lender about your FHA loan choices.

Related Home loan Articles

The Government Construction Government (FHA) has actually launched large FHA loan restrictions to have 2025. They are the financing restrictions getting solitary-family unit members houses ordered underneath the FHA financing program to possess domestic genuine house doing four gadgets sizes.

Precisely what do you must know from the loan denial? Using FHA lenders evaluate multiple factors about a keen FHA mortgage application, and you may knowing what they appear to have makes it possible to top get ready for the next time.

FHA loan rules allow advance payment let that suits FHA and you can bank standards. You can aquire deposit current fund help from a state institution or other bodies program, parents, and companies.

First-go out home buyers usually are worried about the degree of the down-payment requirement with a new mortgage. That is one reason why FHA mortgages are very popular with certified borrowers – the 3.5% down-payment specifications is an excellent replacement most other mortgage loans.

A keen FHA home loan can be obtained to whoever economically qualifies and you may isnt limited to earliest-day home buyers otherwise anyone who has never had assets in advance of. Eg Virtual assistant mortgage brokers, and you will USDA mortgages getting rural portion, this new FHA financial system try a government-supported financial.

FHA home loans are not restricted to very first-go out homebuyers, however the FHA home loan system is a great choice for those individuals who’ve never owned property just before–there’s a minimal advance payment needs plus versatile FICO rating assistance for FHA mortgages.

Related Financial Terms

Settlement costs cover all the costs and will set you back that want so you’re able to be distributed just before otherwise during the time of closing. Their home loan package and you may disclosures go over most of the will set you back one might possibly be sustained from you given that visitors, the seller, in addition to bank.

Your credit score is a number one stands for their creditworthiness so you can lenders who happen to be determining whether to grant you financing. Fico scores are definitely the extremely widely accepted fico scores.

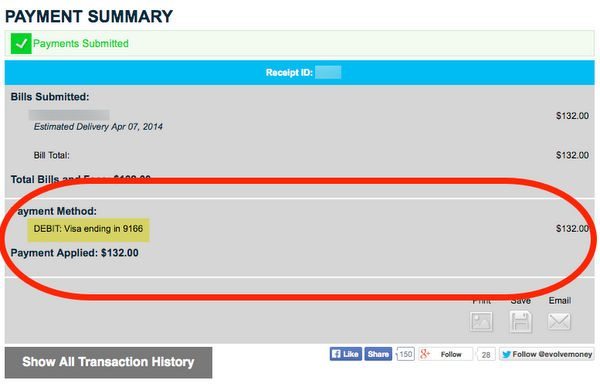

The advance payment in your house is extent you pay the lending company initial to help you secure the financing. The quantity changes predicated on what you could pay for, and financing standards that will vary with respect to the financial.

Home guarantee is the level of control you have on the household. Brand new security on the loan places Gretna FL family increases as you build costs, since you own a lot more of they.

Your lender is the individual otherwise establishment granting you a mortgage loan. Lenders mortgage your money buying property, for the comprehending that you are going to make typical repayments, having interest, to settle the mortgage.

While looking for yet another home, we sign up for a mortgage in order to money they. This might be that loan which allows one borrow cash so you’re able to find the assets, while making monthly payments to repay your debt having appeal.

Related Issues and you can Answers

While the most common FHA mortgage candidate has established some type regarding credit rating, particular individuals are only starting out. A good borrower’s choice to not ever have fun with otherwise expose borrowing from the bank to establish a credit history might not be used as reason behind rejecting.

Probably one of the most key factors of going your credit rating in shape before you apply to have an FHA mortgage loan try go out. If you think your own credit is actually terrible profile, you ought to establish payment accuracy over a period of at the very least 12 months getting.

Mortgage refinancing is a fantastic selection for borrowers who want so you’re able to re-finance for the a reduced interest otherwise payment per month. Streamline refinance finance create FHA individuals refinance with no always necessary appraisal otherwise credit check.

Looking around for the ideal home loan allows you to come across best financing form of a keen the best offer. A mortgage are a product or service, identical to a car or truck, so that the rate and terms and conditions can be flexible. You’ll want to evaluate all will cost you in it, be it to possess an excellent h.

Information exactly what your monthly payment otherwise their interest will be is not sufficient. Require information about money with similar amount borrowed, however with other loan terms and conditions otherwise mortgage models you can also be examine you to pointers.

Mortgage insurance is a policy you to definitely protects lenders against loss you to definitely originate from non-payments to the mortgage loans. FHA need one another upfront and you will annual financial insurance policies for everyone borrowers, long lasting number of down-payment.