Are you presently seeking to dictate the maximum amount you can use together with your newest paycheck? If yes, you’re best off with the knowledge that the quantity relies on multiple issues. Your income is not the merely determining basis. Furthermore, the bank features an alternate formula and regulations in order to assess the newest restrict financing number to have a given paycheck. Therefore, the total amount you could obtain differ regarding bank so you’re able to financial.

Continue reading this website to learn more about figuring your limitation borrowing potential. The blog also answer questions associated with a personal bank loan with the good 50,000 salary .

Limitation Personal bank loan To have 50,000 Income

Really lenders utilize the multiplier way of assess the most personal mortgage having an effective fifty,000 paycheck . It involves dealing with a fixed multiple into income number.

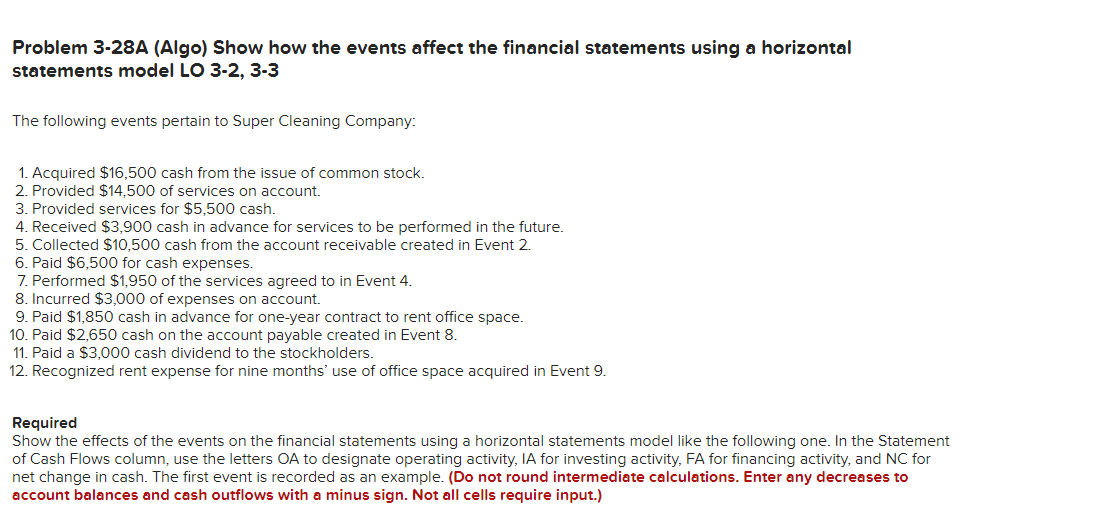

According to lender, the brand new multiple will be ranging from ten and you may 24. The fresh new desk less than will provide you with a good notion of the latest restrict personal bank loan having a fifty,000 income.

Ideas on how to Determine Your Limit Borrowing from the bank Skill

The factors on which the utmost consumer loan having an effective 50,000 paycheck depends on are how much cash you create, your credit score, additionally the version of financing you may be trying to get.

- Income

Your income find your purchasing skill. A lender is willing to mortgage you a price that you could conveniently pay together with your money during the time regarding app.

- A career Standing

Their a position position impacts the borrowing potential. Loan providers be comfy cleaning programs out-of individuals with an everyday income. Your credit capabilities is rather straight down if you don’t have one to. Oftentimes, lenders will get refuse software regarding those people without a frequent earnings. This occurs in the event the exposure is viewed as are excessive.

- Credit rating

When you have a good borrowing from the bank history, portrayed of the a credit score more than 800, it’s possible so you’re able to use a lot more.

- Years

While you are approaching retirement age otherwise your own regular money often prevent or fall off, their borrowing from the bank capacity have a tendency to drop off notably.

If you want to determine how much cash you can aquire as a consumer loan towards an excellent 50,000 paycheck , the easiest way is to apply a finance calculator. It is an internet tool used to decide just how much you might borrow considering your income, possessions, or any other circumstances.

Approaches for a softer Consumer loan Application

For many who curently have a lender willing to provide your currency, you could sign up for an unsecured loan towards the an excellent 50,000 salary . There are what you should notice ahead of time implementing for fund.

- Make sure to provides a keen itemised variety of all personal debt and you may expenses. Their financial can get inquire about it during the application procedure. These details are necessary to work-out the using capacity. They takes on a crucial role in choosing how much money the latest bank can also be give you without causing a hefty danger of standard. Which have these records gathered could make the application form process easier. Definitely features reveal thinking about how you would pay back any leftover obligations. It is among the many inquiries the loan agent may query your for the software procedure.

- Besides these online installment loans Utah, you will want a set of data. They have been:

- An authorities-approved images label card. You can make use of your own Aadhaar Cards, riding licence otherwise Voter ID for this reason.

- Then there are to offer proof your income. Salary glides are ideal for it goal. Yet not, specific loan providers also can inquire about a duplicate of the passbook.

- Additionally, you’ll have to develop target facts and, in some cases, a terminated cheque. Its to show which you have a dynamic savings account.

Rates of interest with the an unsecured loan

One good way to evaluate an unsecured loan to help you a great 50,000 salary should be to go through the interest rate. When considering rates of interest, you ought to go through the cost lifetime of the mortgage.

Short-identity money have a higher rate of interest, while you are a lot of time-label money may have a lowered interest. Unsecured loans are available at highest rates as compared to other kinds of funds, such as house and you will education finance. There is also a comparatively shorter cost several months.

Interest levels for personal money on an excellent 50,000 income include financial so you can financial. Hence, examining with quite a few loan providers regarding their loan has the benefit of is vital before you begin the job. By doing this, you can find the very best deal for yourself.

Loan providers often advertise down rates to have fund while in the festive year. You might take advantage of like opportunities when you’re seeking to a loan.

Repayment Plan to have an unsecured loan

When you borrow funds of a lender, you must make monthly installments until the financing try paid off. The loan words given by very lenders will include the new payment agenda. The fresh new payment schedule having a personal bank loan includes the newest monthly commission matter, when the repayments begin and the moratorium several months, in the event the applicable.

The duration of this new cost agenda will also depend on the kind of financing you take. Most high finance gets a term ranging from 10 in order to thirty years. In the case of a personal bank loan, the new fees agenda is significantly less. The true big date, as mentioned, is dependent upon how much money you’re borrowing from the bank. But you will possess some say in restoring the loan cost schedule. Yet not, you are going to need to developed guidance within the wide variables the lender keeps set.

Conclusion

With additional digitisation inside the financial, you can easily get personal loans to your a great 50,000 income on line. The loan providers supply the accessibility to on line applications. Top lenders also have financing and you will EMI calculator. You can utilize these to dictate the mortgage you can acquire for the websites salary. Apart from the noticeable benefits, this will help to your see whether or otherwise not you might spend from the mortgage on the specified go out.

To ascertain how to work for by using EMI hand calculators, is the only created by Piramal Funds . Look for its articles having a much deeper knowledge of exactly how such hand calculators work.